Guest Post by Yasi | Fast Track Life

Meet Yasi, she is the super smart and energetic founder and creator behind Fast Track Life and the host of the Fast Track Podcast. She enjoys meeting new people and having engaging conversations. Her show is all about helping you get the most insightful tips and advice that you don’t learn from school. She covers topics ranging from entrepreneurship, personal finance, career development, and more, helping you launch your life on the fast track!

In today’s guest post Yasi writes about intercultural differences and how they affect our money mindsets. Over the course of her career she has lived and worked in 8 countries! We hope readers can learn by comparing and combining the strenghts of different mindsets – unlocking your intercultural money mindset!

The floor is yours Yasi!

In the past years, I have spent time living in different countries. Although the cultural differences are obvious to observe, and many people are aware of them, money mindsets have not been talked about frequently!

It is interesting for me to see how people treat money differently in Europe compared to Asia. Although I can only share my personal observation and experiences, it may trigger some self-reflection, if some of your money attitudes are inherited from your parents or society. It is worthwhile to understand why there are those differences.

Shops are closed on Sundays

I remember when I first arrived in Europe, in France, I was not used to the fact that all shops closed after 5 or 6 pm. And on Sunday almost all the shops are closed. While back in China or in Singapore, I can still pop into the shop to buy some food. I am sure it was a cultural shock for many as well.

The question many people coming from Asian countries had at that time was: Why they close the shops when they could be making more money?

If you are a reader from a European country, you may naturally understand why people do not work on Sundays. It is a resting day, to spend time relaxing, at home or with families.

However, people from Asia in my own observation, have the “hustling spirit”. They work hard, they want to create better lives for their families and themselves and they are willing to put in the work to achieve it. Many young people I know have side hustles. They investigate how to buy real estate property, how to progress with their career, how to make money from investments, how to sell things online, of all sorts.

Saving First

There is a “general money mindset” in the Chinese culture: Saving!

There is an old saying: Prepare for rainy days!

Before you need a lot of money for medical expenses, or for retirement, or for children’s education, save as much as you can. Maybe one day you will need the money for an emergency. There is barely any thoughts of relying on the social system, either to cover medical expenses or retirement.

For example, the Swiss pension system is quite well designed according to my article, check out my article Simple Explanation of the Pension Fund in Switzerland. In Singapore, one can easily accumulate more than SGD$1 -2 million in their pension fund thanks to the higher interest rates.

That is why people tend to focus on saving in order to be self-dependent. I guess because countries in Asia have a shorter history of being independent, that is why these systems need to take time to be developed and perfected further. Unlike European countries, which are independent for hundreds of years, they had the time to build those systems, in terms of social security and pension.

On the other hand, if a country has a great system that the citizens trust wholeheartedly. There is no reason for most people to worry about their retirement, their medical expenses and the cost of education. Those are the basic needs of everyone. Therefore there is less reason to “save for the raining days”.

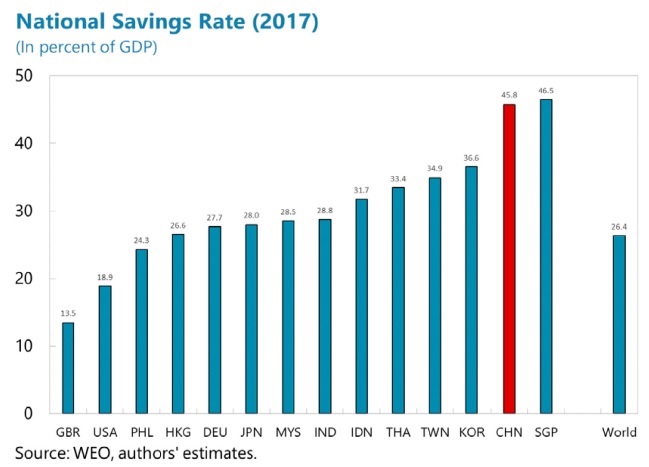

Countries with high income do not necessarily have a high savings rate. A person that makes $100,000 per year and spends $90,000 has a savings rate of merely 10%. While a person that makes $20,000 per year and spends $10,000 has a savings rate of 50%. The same $10,000 can have a completely different impact.

China has one of the highest savings rates in the world, so does Singapore. Even though the graphs from the report IMF working paper: China’s High Savings: Drivers, Prospects, and Policies is dated from 2017, it indicates that Asian countries have higher savings rates compared to the world average.

Investing and The Role of Real Estate

Switzerland has long been famous for its banking industry. As a result, there are a lot of professionals who are in the banking sector. They have the education and professional experience in managing money (I think so). If you talk to 10 Swiss people, at least more than half of them would have some knowledge of tax and investing. In Switzerland, people need to file their own annual taxes. I was impressed that the government expects every citizen to file their taxes in time. In Singapore, it is usually done by the companies and you just need to go to the portal and click a button. Of course, you could also hire someone to do your tax in Switzerland, but most do it themselves. Just the general expectation that people need to do their own tax is unusual for me.

I also know many Swiss people who have invested in precious metals, company stocks, and so on. Maybe not everyone does it but in my experience, it is not uncommon.

On the other hand, the banking industry or the financial industry in China is still developing, booming, and changing fast. As a result, people who are in their 50s or 60s did not have so many opportunities to invest their money especially those who live in rural areas. Therefore saving is the only option known to them to keep their money.

It is interesting to see that the younger generation or even those who are in the 40s or 50s have started investing in funds and stocks. One of the most popular choices though is natural real estate. The role of real estate is considered as a primary need, then as an investment. People believe that when owning real estate, they feel secure and stable. Having your own roof is the first priority for everyone in China. When a couple gets married, they first need their own property to start a family, not a rental property. While in Switzerland, people are comfortable with renting.

In Switzerland, around 30% of people own homes, the other 70% are renting. The rental market is pretty reliable, and you are protected by contracts, and sometimes the apartment owners are pension funds. So you can live in a rental property as long as you want. This is not the case in China or Singapore. Most people who rent, rent from private owners. Therefore there will always be some unpredictable changes, for example, the owner wants to sell or renovate the apartment or suddenly asks for a higher rental price.

As you can imagine, saving for the downpayment to purchase a first property is the top priority for many people in China. Be it a primary need or an investment, it has proven to be the best investment of all.

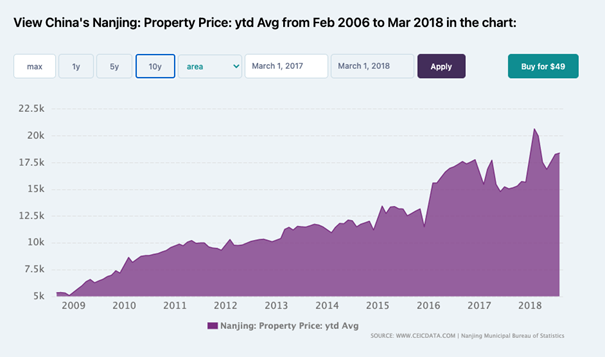

Let me give you an example of how ‘expensive’ real estate in China is. Nanjing is a city in China, I didn’t take Beijing, Shanghai, or Shenzhen because the real estate prices there are extraordinary high. I take Nanjing City as a representative of how expensive apartments are vs. average income.

Housing prices went from just above CNY 5,000 ($772) per square meter in 2006 to around CNY 18,000 ($2,780) per square meter in 2018. It has more than tripled in only 11 years.

I didn’t find 2018 data, but even in 2020, the average monthly salary is CNY4623. What it means is that if you don’t spend anything, you can afford to buy 1 square meter. The downpayment ranges from 20% to 60% depending on local regulations and your personal situation. In order to save for an 80 sqm apartment, with a 20% downpayment, a person with an average salary needs to save for 5.2 years without spending any single cent of earned income! If you need to save 40%, then you’re saving for 13 years.

However, housing prices might keep running higher, maybe triple again? How will it then be possible to ever afford your own apartment? The answer is financial support from parents’ saving, or/and side hustles.

When you have children, you will naturally start saving for them too, so that when they plan to buy an apartment, you can help them out. This is how it works in early 21st century China. Parents support children, children support their children.

Many of those who managed to buy more than one property have made awesome profits as you can see how much the market has grown.

In other words, in an expensive location for Western circumstances: In Switzerland it’s 5 times easier to afford an apartment. With a stable rental market and system, people don’t need to buy apartments. They don’t need much more money to pay for a downpayment, therefore they don’t need side hustles to create more income. Life is much more comfortable and relaxed.

Family and Money

In Chinese culture, families are comfortable to lend money to each other. It could be your aunt borrows money from your mom, or your grandpa’s brother borrows money from your dad, and so on. It is quite common for people to borrow money from their relatives for emergency use and paying back later. Most common example is when a young couple is about to get married and they need ten thousand more CNY for their downpayment, they could borrow money from their relatives and pay them back later. I think it is not so common in Europe at least not in Switzerland.

Learning from Both Sides

There are too many deep-rooted social reasons that influenced how people behave. The more I researched this topic, the more I find it not reasonable to put two cultures on the same ground to compare. They are not comparable, just different.

In my recent Fast Track Podcast episode with Marco Matti, who lived in China before and understands the culture pretty well, we talked about the working culture difference and the role of social media. I really like how he sees everything with an open mind.

I think each of us can learn from other cultures, mindsets, and pick what fits us best.

Yasi | Fast Track Life

Thank you so much for sharing your insights Yasi!

Please check out Yasi’s podcast episode with me, we would also love to welcome you to join our weekly Youtube live sessions talking about money and life. Together with Yasi we’re also working on a Money Course to Fast Track your money life, find out more following the link!

Please feel free to share your own lessons regarding intercultural mindsets and perspectives!

Stay tuned and talk soon,

Matt

True that! Cultural and geographical differences affect the money mindset. The thing I observed about Indians is due to the varied culture within the country you will see different attitudes towards money.